Genesis, which earlier that year allegedly experienced losses of several hundred million dollars as a result of its exposure to failing cryptocurrency hedge fund Three Arrows Capital, finally gave up after FTX collapsed in late 2022.

After suffering losses from two of the greatest sector failures of 2022, Genesis Global Holdco LLC, the parent company of embattled cryptocurrency lender Genesis Global Capital, filed for Chapter 11 bankruptcy protection.

Three voluntary applications were submitted to the bankruptcy court by Genesis Global Holdco, LLC, Genesis Asia Pacific Pte Ltd, and Genesis Global Capital, LLC. The same company that controls CoinDesk, Digital Currency Group, encompasses all three. Genesis has proposed cooperative case administration.

The partner company to Gemini’s now-defunct Earn program, Genesis Global Capital, projected more than 100,000 creditors and between $1 billion and $10 billion in liabilities as well as assets in its filing. The assets and liabilities of the other two companies were believed to be between $100 million and $500 million, respectively.

According to the bankruptcy petition released late Thursday, Genesis owes more than $3.5 billion to its top 50 creditors, including cryptocurrency exchange Gemini, trading behemoth Cumberland, Mirana, MoonAlpha Finance, and VanEck’s New Finance Income Fund.

These businesses make up Genesis’ crypto financing division, which was upended by the collapses of hedge fund Three Arrows Capital and cryptocurrency exchange FTX last year. According to a press release, Genesis’ other companies that are active in the derivatives, spot trading, and custody sectors, as well as Genesis Global Trading, were not included in the filing and still conduct client trading.

Genesis Global Capital stated in its statement that it anticipates there would be money left over after the restructuring process to pay unsecured creditors, a class of creditors who may be completely eliminated in bankruptcy proceedings if the situation is particularly grave.

Customers of a yield product offered by the Winklevoss brothers’ cryptocurrency exchange, Gemini, were harmed when Genesis Global Capital was compelled to restrict client withdrawals shortly after FTX fell into its own bankruptcy case in November.

Genesis has been frantically trying to find new funding or work out a solution with its creditors. It was under increasing pressure to repay $900 million in frozen deposits, along with parent business Digital Currency Group (DCG), which also owns CoinDesk.

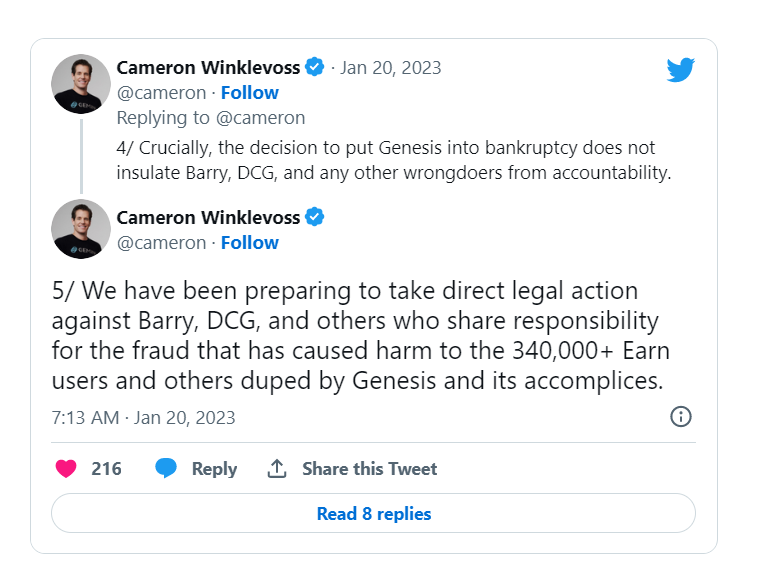

Cameron Winklevoss of Gemini tweeted immediately after the case was made public that the bankruptcy “is a vital step towards us being able to retrieve your assets.” The CEO of Gemini threatened to sue DCG CEO Barry Silbert for the loan repayment in the same series of tweets. The tweet follows Winklevoss’ Twitter battle with DCG to recoup the debt while dealing with difficulties in his own exchange.

Late last year, Genesis hired Moelis & Co., an investment firm, to help with the options research.

Before FTX handed Genesis a hit, Three Arrows Capital’s failure as a cryptocurrency hedge fund cost the company hundreds of millions of dollars in losses, CoinDesk first revealed last year.

Genesis said earlier this month that it will reduce its workforce from 145 to 145 by 30%.

Due to the fact that Genesis and digital asset management Grayscale are owned by the same parent company in DCG, the bankruptcy filing on Thursday may have wider ramifications for bitcoin. Grayscale runs the Grayscale Bitcoin Trust (GBTC), which manages assets worth more than $10 billion and was trading at a record discount to net asset value as of late last year, but that gap has lately shrunk. Market participants are concerned that the effects of the Genesis bankruptcy may possibly result in the liquidation of GBTC’s assets of more than 600,000 bitcoin.

A source: https://www.coindesk.com/